I already used CCXT Library in my Airflow-related post here. In this post, I am specifically going to discuss the library and how you can use it to pull different kinds of data from exchanges or trading automation. The demo can be seen here.

What is CCXT

CryptoCurrency eXchange Trading Library aka CCXT is a JavaScript / Python / PHP library for cryptocurrency trading and e-commerce with support for many bitcoin/ether/altcoin exchange markets and merchant APIs. It connects with more than 100 exchanges. One of the best features of this library is that it is exchange agonistic, that is, whether you use Binance or FTX, the signature of routines are the same. It is available in Python, Javascript, and PHP. It supports both public and private APIs offered by different exchanges but I am only going to discuss a few public API endpoints.

Development Setup

Installing the library is very easy. All you have to do is to run pip install ccxt in terminal.

Alright, the library is installed, let’s connect an exchange. I am connecting Binance exchange for now.

Connect to exchange

The very first and obvious step is to connect the exchange first, it is pretty easy.

# Connect binance binance = ccxt.binance()

Loading Markets

The exchange is connected, now it’s time to load all markets offered by the exchange. Usually, it is not used but it can give you a good idea of whether a certain pair is available or not.

Fetching Ticker

Let’s grab the info related to BTC/USDT.

btc_ticker = binance.fetch_ticker('BTC/USDT')

btc_ticker

and it returns:

{'symbol': 'BTC/USDT',

'timestamp': 1634909924391,

'datetime': '2021-10-22T13:38:44.391Z',

'high': 65564.0,

'low': 62000.0,

'bid': 63363.89,

'bidVolume': 1.32351,

'ask': 63363.9,

'askVolume': 0.27138,

'vwap': 63105.52714333,

'open': 65470.0,

'close': 63363.9,

'last': 63363.9,

'previousClose': 65469.99,

'change': -2106.1,

'percentage': -3.217,

'average': None,

'baseVolume': 53395.84423,

'quoteVolume': 3369572897.3972454,

'info': {'symbol': 'BTCUSDT',

'priceChange': '-2106.10000000',

'priceChangePercent': '-3.217',

'weightedAvgPrice': '63105.52714333',

'prevClosePrice': '65469.99000000',

'lastPrice': '63363.90000000',

'lastQty': '0.00843000',

'bidPrice': '63363.89000000',

'bidQty': '1.32351000',

'askPrice': '63363.90000000',

'askQty': '0.27138000',

'openPrice': '65470.00000000',

'highPrice': '65564.00000000',

'lowPrice': '62000.00000000',

'volume': '53395.84423000',

'quoteVolume': '3369572897.39724530',

'openTime': 1634823524391,

'closeTime': 1634909924391,

'firstId': 1109039843,

'lastId': 1110609081,

'count': 1569239}}

Apart from Ticker and Timestamp, it returns data points like Open, High, Low, Close, Volume, Bid and Ask Price, etc.

Fetching OHLCV data

Fetching OHLCV data is pretty easy, all you have to do is:

btc_usdt_ohlcv = binance.fetch_ohlcv('BTC/USDT','1d',limit=100)

here, the first argument is the trading pair, the second is duration which tells whether you need a day level data, minutes, or a month. Each OHLCV entry represents a candlestick. Since the difference of time duration is a day, the data will always be in 24 hours of difference starting from 12 AM Midnight UTC. The last parameter, limit is optional. When you print it, the data is returned in the following format:

[[1634774400000, 66001.4, 66639.74, 62000.0, 62193.15, 68538.64537], [1634860800000, 62193.15, 63732.39, 62000.0, 62680.01, 24059.82478]]

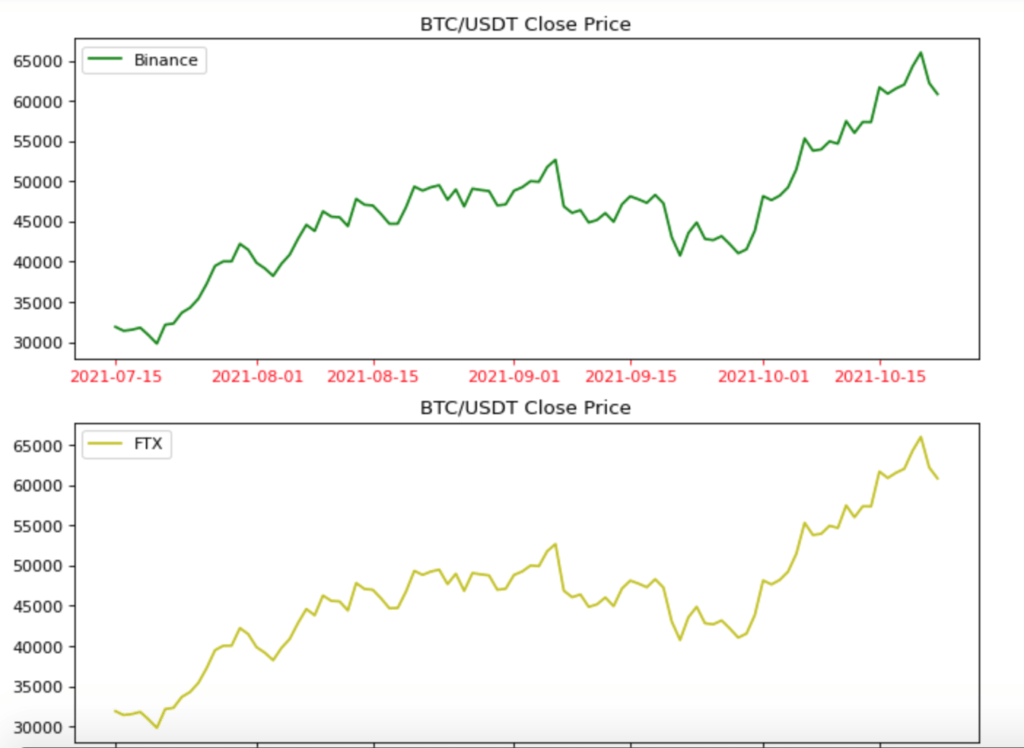

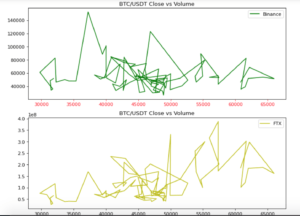

The data returns in the format: TIMESTAMP, OPEN, HIGH, LOW, CLOSE, and VOLUME. Let’s make it interesting. I will pull BTC/USDT price from Binance and FTX exchange and plot the graph of close values.

Pretty dirty, right? as if a kid sketched something on paper but then this is called volatility!

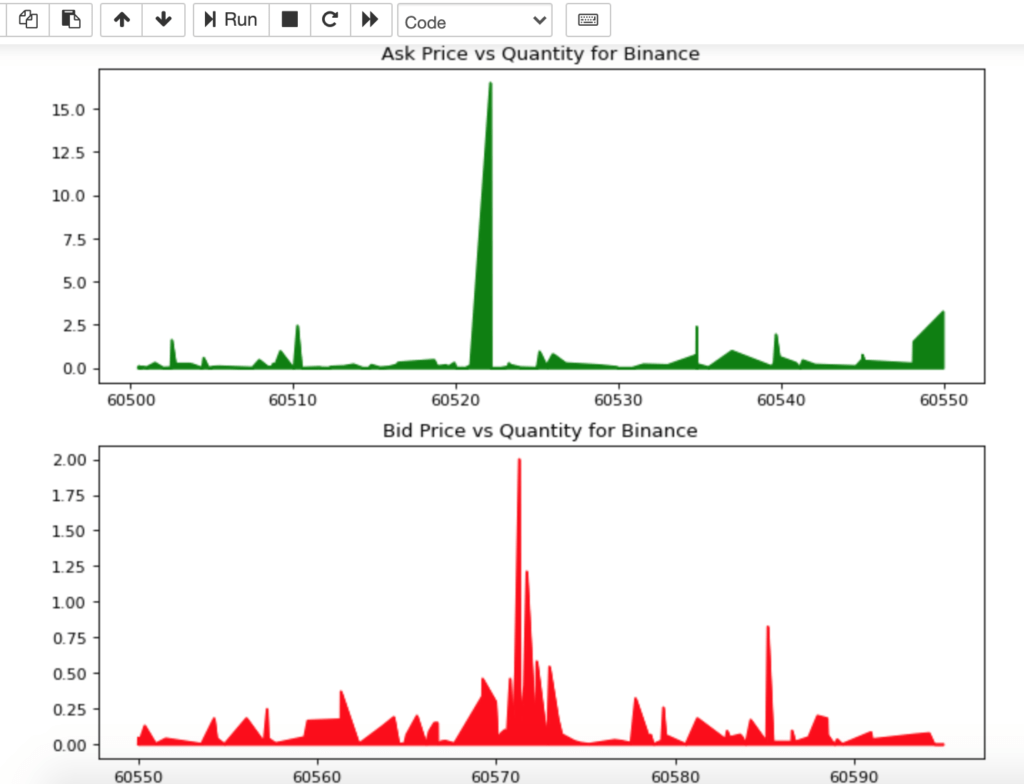

Fetching Orderbook

Now let’s pull up the order book from Binance and FTX.

orderbook_binance_btc_usdt = binance.fetch_order_book('BTC/USDT')

orderbook_ftx_btc_usdt = ftx.fetch_order_book('BTC/USDT')

bids_binance = orderbook_binance_btc_usdt['bids']

asks_binanace = orderbook_binance_btc_usdt['asks']

df_bid_binance = pd.DataFrame(bids_binance, columns=['price','qty'])

df_ask_binance = pd.DataFrame(asks_binanace, columns=['price','qty'])

Let’s plot the graph!

fig, (ax1, ax2) = plt.subplots(2, figsize=(10, 8), dpi=80)

ax1.plot(df_bid_binance['price'], df_bid_binance['qty'],label='Binance',color='g')

ax1.fill_between(df_bid_binance['price'], df_bid_binance['qty'],color='g')

ax2.plot(df_ask_binance['price'], df_ask_binance['qty'],label='FTX',color='r')

ax2.fill_between(df_bid_binance['price'], df_bid_binance['qty'],color='r')

ax1.set_title('Ask Price vs Quantity for Binance')

ax2.set_title('Bid Price vs Quantity for Binance')

plt.show()

And it produces…

Cool, Isn’t it?

Conclusion

SO this was a brief intro to the CCXT library. I just scratched the surface. If you are interested you may create a trading bot based on this library. Several have done it before. Like always, the code is available on Github.